Example Journey Map

JOURNEY MAPPING

Objective

Deeply understand the journey people go through to find mental health care including the key moments of inflection in the journey and how, when and why they seek care online. Leverage insights to further develop the client’s brand positioning and more clearly target potential customers.

Approach

Journey Mapping: Prior to live discussions, participants were asked to self-document their journeys with DTC mental health services via an online journaling tool.

1:1 Interviews: Participants then added depth and detail to their journeys through deep discussions of their experiences, related emotions at each step, key inflection points and unmet needs.

Deliverables

Journey Map: A detailed map was created outlining each step of the journey, related emotions, moments of truth and paint points. Opportunities to serve the consumer at each step of the journey were also identified.

Report of Findings: A report was developed to support the journey map and detail key opportunities around how to refine the client’s brand positioning, expand the current service offering, and how to improve communications to highlight where the brand can solve key consumer pain points.

BRAND LAUNCH RESEARCH

FINE JEWELRY START-UP

Objective

Engage consumers immediately after brand launch to understand early reactions to the brand, the shopping experience and the product. Identify opportunities for quick tweaks to the experience as well as longer-term growth opportunities.

Approach

Phase 1 – Pre-Assignment: Prior to live discussions, group participants were asked to shop the brand and share their reactions, upload photos of their current jewelry collections, and share a story of how and why they purchased a piece from their collection.

Phase 2 – Discussion Groups: Participants were divided into four groups based on category attitudes. Discussions revolved around the role of jewelry, shopping habits and exploration of the concept leveraging the group dynamic to understand points of inflection and overall level of excitement.

Phase 3 – 1:1 Interviews: Insights identified in group discussions were further explored. Participants were exposed to the concept in real time then asked to shop the site and share their reactions.

Deliverables

Rapid iterations: Insights were shared in real time and quick-turn actions were immediately applied including changes to site navigation, product prioritization and language.

Debrief: Longer-term recommendations were outlined including around how to introduce the brand to consumers, key differentiators and how to prioritize key products on the site and in marketing communications.

PRODUCT DEVELOPMENT

TECHNOLOGY LEADER

Objective

Understand consumer perceptions and reactions to new, innovative technology concepts. Â Determine viability of each concept and refine for a large quantitative study.

Approach

Online co-creation sessions with respondents and client team members were conducted over a three week period. Respondents reacted to concepts via an online bulletin board. Client was led through rapid ideation sessions to iteratively evolve and refine concepts throughout the testing period.

Deliverables

Weekly Debriefs: Debriefs summarizing respondent insights, team ideations and next steps.

Summary Report: A final report outlined the evolution of each concept with recommendations for further refinement for quantitative testing.

PRODUCT TESTING

INNOVATIVE HAIR CARE

Objective

Engage relevant consumers to validate a concept for an innovative hair care brand, understand how it aligns with customer needs, explore reactions to existing product and marketing, and identify opportunities to build out a successful growth strategy.

Approach

Phase 1 – ‘Unboxing’ Groups: Product was sent to each customer’s home along with marketing materials and specific instructions about usage frequency and reporting. Customers were divided into three groups to cover discussions of hair care needs and goals, as well as unboxing the product in real time to capture reactions.

Phase 2 – Product Testing: Customers then tested the product over a period of 4 weeks and completed periodic surveys to gauge product appeal, ease of use and perceived efficacy.

Phase 3 – Customer Re-Groups: At the end of the testing period, customers came together again to discuss the product experience, how well branding and marketing align with the product experience and to identify opportunities for improvement in all aspects of the brand including product, branding, marketing and communications.

Deliverables

Team Workshop: Insights were workshopped with the brand and product teams to identify and prioritize action items around marketing, education, and product development.

Video highlight reel: A video was created to showcase key insights in the customers’ own words.

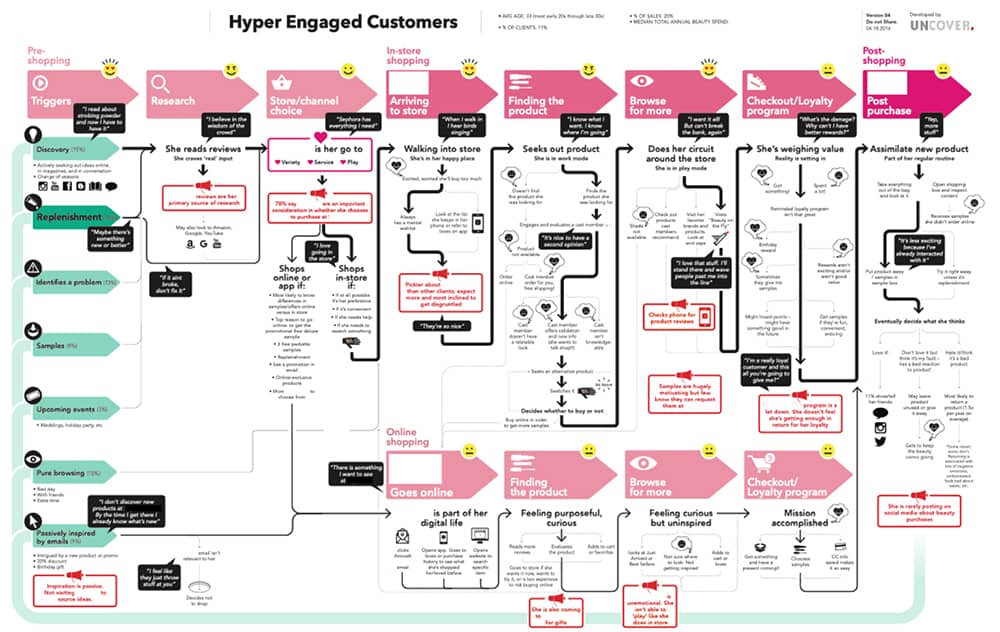

JOURNEY MAPPING

MAJOR APPAREL RETAILER

Objective

Create a detailed map of the customer shopping experience. Â Understand pain points throughout the shopping experience and identify key opportunities for innovation.

Approach

Focus Groups: A series of shopping workshops were conducted across multiple markets. Respondents were led through strategic exercises designed to identify and define each step of their shopping experience.

Deliverables

Respondent created journeys: Following each group, a respondent created rough map was provided with group consensus as well as outlier tangents.

Journey Map: Using the respondent created maps and insights uncovered during fieldwork, a detailed, professionally designed journey map was created showcasing the process from inspiration to purchase. The map included quotes from fieldwork and customized icons to illustrate findings. Quantitative data was overlaid to reinforce key themes.

CUSTOMER DEEP DIVE

MAJOR APPAREL RETAILER

Explore and expand on quantitative findings to develop a deep understanding of the 22 – 24 year old female target customer and identify key opportunities to better serve them.

Approach

Expert interviews with fashion stylists, editors and bloggers.

Customer led shopping tours of 5 stores customers love and couldn’t live without.

In home interviews including closet explorations and online shopping demonstrations.

House parties hosted by customers at their homes with their friends. Informal chats and moderated discussions of key topics were conducted.

Deliverables

Videos: 5-minute customer intro highlighting defining characteristics of the target and a 2-minute leadership video highlighting the most salient insights for use in a board meeting.

Comprehensive Report: Detailed analysis and in-depth description of the target rich with still photographs and quotes from the fieldwork

COMPETITIVE DEEP DIVE

LEADING ATHLETIC SHOE RETAILER

Objective

Develop a creative, multi-media presentation designed to create an understanding of the consumer loyalist’s perspective of three key competitive brands.

Approach

In-Home Interviews were conducted among loyalists of competing brands. The Interviews were professionally filmed to ensure a rich presentation.

Deliverables

Videos: 3 minute highlight videos for each of the three competitive brands showcased the essence of their loyalty.

Live consumer panel: Respondents who best represented the competitive loyalists were brought to a C-level off-site https://jobitel.com/ to participate in a moderated panel. Audience members were able to engage directly with the competitive loyalists for a lively and informative discussion.

Infographics: Three infographics were created to add further insight to each competitive brand and served as a leave-behind for all off-site attendees.